Early Retirement by Bitcoin

Episode XXIV. Block height: 871000. With each sat stacked, you're not just investing in Bitcoin, you're building the path to a future of freedom. And we have proof.

What an extraordinary time to be a Bitcoiner. Following Donald Trump’s election in early November 2024 and Bitcoin’s surge past its previous all-time high of $73,500, we’re witnessing a remarkable ascent, with Bitcoin reaching $90,000 for the first time in history. Congratulations to all the dedicated stackers and hodlers — it’s been an incredible journey, and this is just the beginning.

This article highlights the transformative power of Bitcoin and illustrates how small, consistent actions can lead to profound financial progress and freedom. It highlights the effectiveness of Dollar Cost Averaging (DCA) in Bitcoin, supported by numbers and graphs to demonstrate the potential. I've been following BRetirementPlan's blog closely for a long time, where he documents his own DCA journey, which shows that achieving financial independence ultimately doesn't require risky strategies. By regularly buying bitcoin with an affordable amount, you can leverage time as your greatest asset. Gradually, then suddenly - sat by sat.

Back in May 2023, we published a joint article on Substack, which we linked at the end for comparison. Now, almost 1.5 years later, it's time to revisit the numbers together and see where the journey has taken us. Time flies, so let's dive in!

The Bitcoin Retirement Plan

Hello, my name is Mr. ERB, and I run the blog The Bitcoin Retirement Plan because that’s my strategy: Since October 2017, I stack Bitcoin each month until I can call myself retired (or retarded), we will see. But first, let me share a bit about my personal journey with Bitcoin.

FIRE strategy

Back in 2017, I began exploring concepts around early retirement, financial freedom, and financial independence — often known as FIRE (Financial Independence, Retire Early). One of the most influential voices in this space is Mr. Money Mustache, whose blog I followed daily for hours on end, sometimes for weeks. This intense commitment to learning was remarkably similar to the passion I developed for understanding Bitcoin shortly after.

Growing up in a not very financially literate family, I learned (at the ripe old age of ~30) about stocks and the stock market in general, and the idea of early retirement and financial freedom, pure magic to my financial beginner brain. In short, these FIRE folks save as much as they can from their paychecks, use it to buy the S&P500 or whatever indices, and keep going until their annual return from the stock (historically 7%) is enough to fund their frugal lifestyle. Basically, this means extreme savings behaviour and commitment for many years (if not decades). I was obsessed with the idea of buying (saving) my freedom from the fiat hamster wheel, so I started saving what I could and bought some stocks for the first time in my life.

Cheat Code

However, as many of you likely understand, things rarely unfold exactly as planned — especially once Bitcoin enters the picture. I initially encountered Bitcoin in an entirely random way and viewed it solely through a FIRE lens, considering it a potential accelerator for my early retirement goals. But, as is often the case, I quickly became captivated by all aspects of it, falling down the proverbial “rabbit hole.” My perspective shifted from that of an early retirement enthusiast to that of a Bitcoin stack maximalist. I immediately realised that Bitcoin would offer me a spectacular and unique cheat code to reach my goal of financial independence, laser-focused.

So my strategy evolved into buying as much Bitcoin as possible, without relying on any lump-sum investments. Instead, I committed to saving the maximum amount from my salary and purchasing Bitcoin consistently each month. I began this approach in October 2017 — ironically, near the peak of that bull market — and have continued ever since, riding out both significant drops and even larger rallies. In essence, I was applying the same disciplined, long-term approach that many in the FIRE community apply to stocks, but Bitcoin felt like the ultimate “cheat code.” With Bitcoin, achieving my financial independence goals seemed not only possible but potentially faster and more impactful then I ever could have imagined.

Don’t trust, verify

I began documenting the progress of my Bitcoin FIRE strategy as a personal project, but over time, I thought others might find value in the journey as well. So, I created a blog to share what it looks like to stack sats from a broke ass noob (Zero-Net-Worth) to hopefully financial independence, one sat at a time. The blog offers insights into how much one might need to save each month to achieve a certain goal, the patience required, the bear markets to withstand, the bull markets that can change everything, the inevitable cycles of crises, and, most importantly, how a remarkable Bitcoin stack can be built steadily over time through the simple, disciplined practice of Dollar Cost Averaging (DCA) without a ton of capital to start with.

Simply speaking, every month, I buy Bitcoin and update my charts that track my Bitcoin Retirement Plan’s progress. In this article, I’d like to share with you the three most significant charts that illustrate the journey so far. I have now been practicing Dollar Cost Averaging (DCA) in Bitcoin consistently for 86 months — stacking sats one step at a time without exception or emotion. Let’s take a look at where we currently stand.

Chart ONE

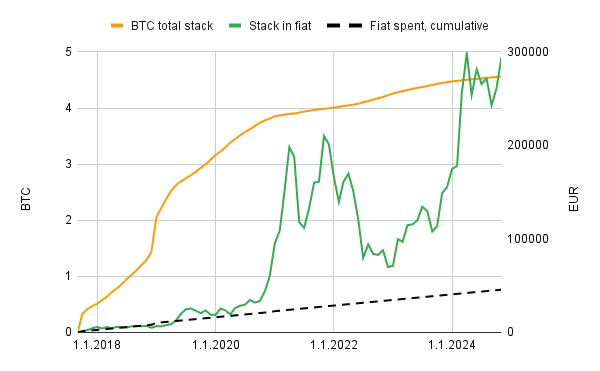

The orange line (left axis) represents my Bitcoin stack, which consistently increase as I continue to add without ever selling. The green line (right axis) shows the fiat value of my Bitcoin stack, calculated at the purchase price for each data point, making it easy to identify bear and bull market phases in fiat terms. The black dashed line represents the total amount of fiat invested over the years — approximately €45,000 over seven years, yielding an average purchase price of €10,000 per Bitcoin. The gap between the black dashed line and the green line reflects my profit in fiat terms, providing a clear view of how well this strategy has performed despite two bear markets along the way.

Chart TWO

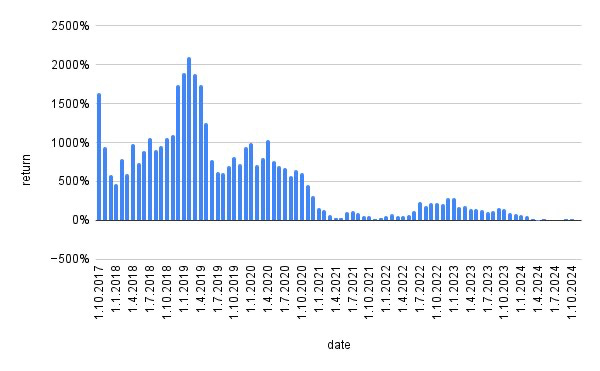

The blue bars represent each of my monthly Bitcoin purchases, 86 in total, beginning in October 2017. Currently, we’re at an all-time high, meaning every single purchase I’ve made is in profit. However, my best buy occurred at the bottom of the bear market in February 2019, with gains exceeding 2000% today. The €500 purchase I made then is now worth over €10,000. In hindsight, I should have sold my last chair and stack Bitcoin even harder at those lows, but at the time, it was daunting to even make €500 monthly purchases in a market that appeared to be in free-fall.

Ultimately, the “buy and hold” approach no matter what has proven to be a winning strategy. It shows that real gains come from holding over the long term, while the “pain” typically stems from more recent purchases during market downturns. In Bitcoin, some level of drawdown is inevitable. Everyone, even early adopters who started in 2011, has faced periods of loss. But the real test is how you handle these phases: whether you wait patiently, get caught in analysis, panic, or press forward with conviction. It’s important to note that it’s nearly impossible to perfectly time the bottom. What matters is that you continued stacking when others hesitated. The takeaway is simple: if you stack consistently, you stand to win in the long run.

Chart THREE

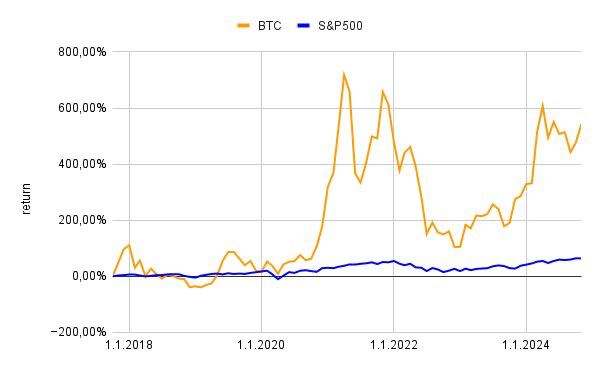

Here, I’m comparing my Bitcoin savings strategy with the traditional FIRE approach, which largely involves Dollar Cost Averaging (DCA) into the S&P 500. This comparison highlights the shift from my original strategy, to the Bitcoin-centric approach I adopted after discovering its potential. The orange line represents the performance of my Bitcoin savings strategy, while the blue line indicates the hypothetical performance if I had invested in the S&P 500 on the same dates and with the same DCA amount. As shown, the Bitcoin strategy has outpaced the S&P approach by a wide margin, delivering approximately 500% returns compared to roughly 60%.

While I understand that some may view Bitcoin as speculative and risky compared to traditional investments, the more one learns about Bitcoin, the less speculative it appears. In many ways, it’s a unique form of information asymmetry. Discovering Bitcoin has felt like finding a “cheat code” to accelerate financial independence and break free from the fiat hamster wheel.

Conclusion

Following a Bitcoin DCA strategy can often feel tedious and, at times, pointless. All hodlers face periods of pain, disappointment, and doubt. However, the key point is this: after enduring these challenging phases, when Bitcoin begins to rise again (and it will), you will always wish you had stacked more. With a consistent DCA strategy, you'll eventually look back and be grateful for having stuck with it, even when it felt like a slow and uneventful process. Bitcoin's journey is always bittersweet; you feel down when the price dips, but you also feel a certain unease when it rises because, naturally, it becomes harder to accumulate more — and let’s face it, you *never* have enough.

After seven years, multiple bull and bear markets, I can confidently say there are no shortcuts in Bitcoin — no quick fixes like buying altcoins, leveraging, or staking on centralized platforms. Don't be tempted to chase these paths; they only lead to losses, as many have already discovered. The only guaranteed recipe for success is commitment and patience. Success in Bitcoin requires time in the market. Your Bitcoin stack won’t materialize overnight, gains won't appear tomorrow, and everyone will be underwater at some point. You will feel foolish at times, but perseverance is key. I hope you all have the strong hands needed to navigate future bull and bear markets. Let’s seize the moment, enjoy the journey, and keep stacking sats!

For those reading this without owning Bitcoin, I understand that it may feel like it’s too late to get in. But here's the reality: everyone feels like they’re late to Bitcoin, regardless of when they start. You can't change the past, but you have full control over the present. Start DCA-ing Bitcoin — it’s simply the best investment strategy. - Mr. Stax

The End

That's it for this episode. I hope you gathered some valuable knowledge from this one and remember: “Time in the market is better than timing the market.” Many thanks to Mr. ERB who ran the numbers for us. Make sure to follow him, and keep up-to-date with his great work!

Twitter: Bitcoin Retirement Plan

Blog: Stacking‘em Volume

Thanks for reading and see you hopefully in the next one. Until then, ₿ critical, ₿ informed, ₿ prepared. Yours,

Education for everyone

Pure, independent and free education. If you want to support my work, you can donate Sats via Lightning. I truly appreciate it!

Not your keys, not your coins

Get yourself a proper hardware wallet: The Bitbox Bitcoin-only! is my favourite. Swiss made, Great customer support and worldwide shipment.

Education is key

[1] Richard Meadows, Optionality

[2] Darren Hardy, The Compound Effect

[3] Guatam Baid, The Joys of Compounding

[4] Saifedean Ammous, The Bitcoin Standard

[5] Edward Chancellor, The Price of Time

[6] Ryan Holiday, Discipline is Destiny