The Bitcoin Retirement Plan

Episode VIII. Block height: 790000. Dollar Cost Average (DCA) Bitcoin for your retirement? The best strategy to provide for your future? We ran the numbers.

The week in Bitcoin

Strike: The global money App moves headquarters to El Salvador and expands to 65 countries. The move to relocate was a response to the growing anti-crypto regulatory sentiment in the U.S.

Strong HODLERS: Bitcoin dormant supply increases as ‘Hodlers’ refuse to sell. Inactive BTC supply has climbed to a record-high. 68% of Bitcoin hasn't moved in over a year, thus Hodler conviction is at its highest point in several years.

Ledger: Co-Founder and former CEO of French hardware wallet company Ledger admits that governments could gain access to your Bitcoin when using Ledgers new ID based recovery ‚feature‘.

High Inflation: Citizens in countries with high inflation rates seek refuge in digital assets. Turkey, Argentina and the Philippines have the highest growth rates in cryptocurrency ownership.

Bitcoin, a national security issue: Two U.S. senators have introduced legislation that they hope will be a safeguard against any risks that El Salvador’s adoption of Bitcoin as legal tender may pose.

Tether: One of the largest stable coins (Tether (USDT) is starting to allocate up to 15% of its net realized operating profits towards purchasing Bitcoin.

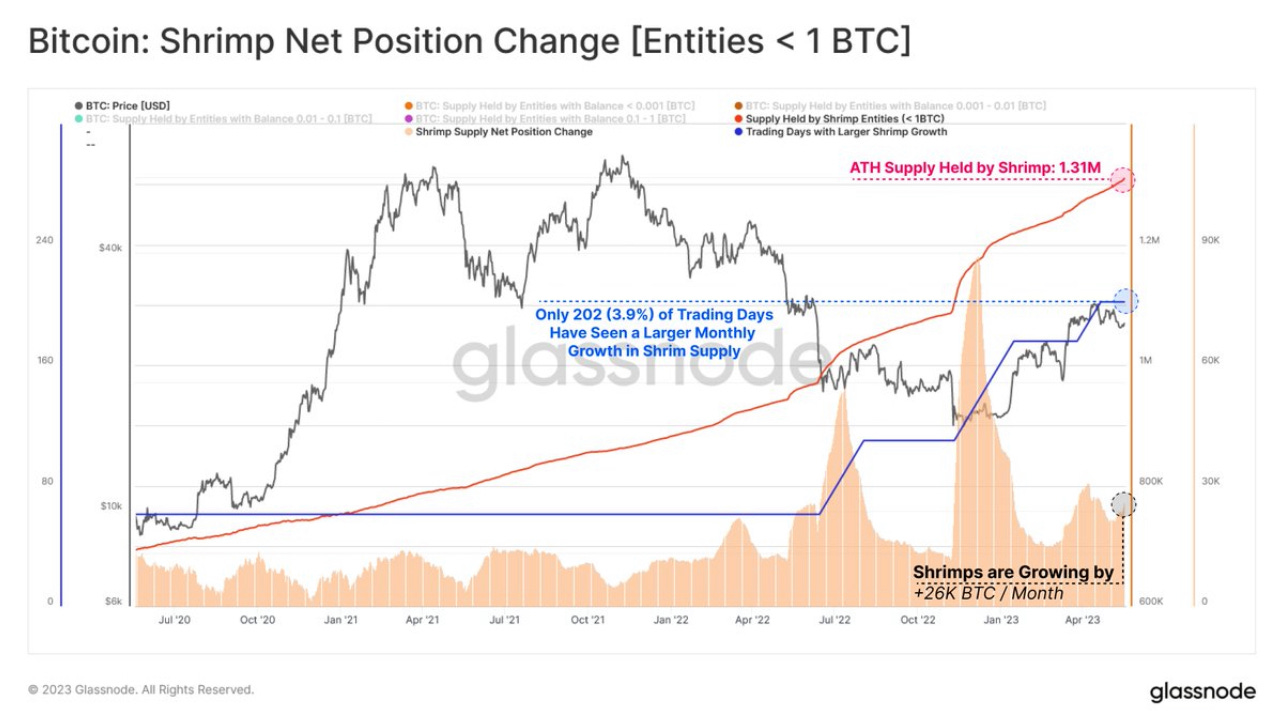

The Cyber-Shrimp Army

A small army of Cyber-Shrimps voraciously and recurrently bringing home the Bitcoin that is mined daily. That's how I imagine the DCA army, including myself. We are the many that buy, even when the ephemera like locusts leave the Bitcoin Noah's Ark by leaps and bounds. We Shrimp who get even more excited when Bitcoin briefly "collapses" once again and is declared dead by mainstream media because it gives us the opportunity to stack cheap Sats.

And according to Glassnode, Bitcoin shrimps (<1 Bitcoin) are growing substantially. In fact, we are hodling 1.31 million coins, adding an average of approximately 26,000 Bitcoin to our cumulative holdings each and every month. Keep in mind, only about 27,000 Bitcoin mined monthly, which will be halved in spring next year due to the Bitcoin halving. Absolutely mind-blowing!

Well, to be honest, when it comes to my Bitcoin stack, I'm not running the numbers, so I don't keep a record of profit and loss on my DCA strategy, in fact I don't even know my average price at which I bought my coins. My only relevant metrics are weather my Bitcoin stack is growing over time and weather the Bitcoin network is healthy, i.e. Hashrate. Both are at all-time high in time of writing. Yeah, buddy!

Nonetheless, it is of course very interesting when people run the numbers and take a closer look at the profitability of DCA, especially compared to other strategies. Thus, I have been following BRetirementPlan for quite some time, who is running the numbers for all of us. I thought it would be very interesting for my audience to share his story and take a closer look at the numbers. This is my first Guest Newsletter episode. So let’s dive in.

The Bitcoin Retirement Plan

Hi, my name is Mr. ERB, and I am running a blog called ‘Early Retirement by Bitcoin’. More recently, I liked to call my strategy ‘The Bitcoin Retirement Plan’. Simply speaking, I buy Bitcoin every month until I can retire from my stack and compare this strategy with others. But first things first. Let me explain briefly my personal Bitcoin story.

In 2017, I started to educate myself and looked into early retirement, financial freedom and financial independence stuff (short FIRE). Probably the most well known blogger in this sphere is called Mr. Money Mustache and I followed his content every day, several hours, for weeks in succession - a very similar behavior than what finding Bitcoin caused a little later.

The FIRE strategy

Growing up in a not very financially literate family, I learned (at the ripe old age of ~30) about stocks and the stock market in general, and the idea of early retirement and financial freedom, pure magic to my financial beginner brain. In short, these FIRE folks save as much as they can from their paychecks, use it to buy the S&P500 or whatever indices, and keep going until their annual return from the stock (historically 7%) is enough to fund their frugal lifestyle. Basically, this means extreme savings behavior and commitment for many years (if not decades). So I started saving what I could and bought some stocks for the first time in my life.

The Cheat Code

BUT as I'm sure you all know, it usually doesn't turn out the way you originally planned, because then came Bitcoin. I heard about Bitcoin in a very random way, initially thought about it *only* from this FIRE point of view as a way to accelerate my early retirement endeavors. Very quickly though, I became, of course, obsessed about all aspects of Bitcoin (just the way it is) and started to think less from a point of view of an early retirement enthusiast and more from a Bitcoin stack maximalist. So my strategy became to simply buy as much Bitcoin as possible but without any savings to lump sum. It basically meant saving the max amount from my salary and buying the max amount of Bitcoin every month. I started this in October 2017 (almost at the peak of the bull market) and have been buying as much as I can every month ever since.

From very early on I was confident that my strategy will be very successful and buy me freedom in a few years (well, 5+ and counting atm). Much like what the FIRE people are trying to do with stocks. But it felt like I had found the ultimate cheat code, and achieving my goal would be much easier and more effective with Bitcoin.

Documenting the numbers

I started documenting the progress of my plan for myself, and after a while I thought maybe people find this content valuable. I created a blog so that people could see how it looks like to stack Sats from zero to hero (or to fail spectacularly) - how much you need to save per month for a particular stack, how many years you need to persist, how many bear markets you need to go through, how many bull markets will finally set you free, how much pain you need to endure, how many ‘crises’ will come and go, and most importantly - how the ‘in the end-impressive’ stack gets built slowly but steadily in a boring DCA fashion.

So, every month I buy more Bitcoin and update my charts that document the progress of my Bitcoin Retirement Plan. In the following, I would like to share with you my three most important charts.

Running the numbers

Chart ONE

The orange line (left axis) is my Bitcoin stack, always increasing since I add constantly and never sold. The green line (right axis) is the corresponding fiat value of my Bitcoin stack, calculated with the purchase price at every data point. You can easily see the bear and bull markets in fiat terms. The black dashed line is the total amount of fiat money that I used to purchase Bitcoin. The difference between the black dashed line and the green line is my profit in fiat terms, giving you some idea of how successful the strategy has been so far, despite two bear markets.

Chart TWO

The blue bars represent every Bitcoin purchase I've ever made, one per month, starting in October 2017. This chart nicely illustrates that the gains always come from holding for several years, and the pain always comes from your recent purchases. There is simply no way to avoid the pain in Bitcoin. Everyone will go underwater sooner or later during their stacking journey, even those who started in 2011 have had their share of pain. But when the time comes, it's up to you whether you wait it out, overanalyze, panic, or just muddle through as a winner. Be warned, you will miss the bottom. What matters is that you stacked while others waited. The bottom line is: If you stack constantly, you win in the long run.

Chart THREE

Here I’m comparing my Bitcoin savings strategy to the standard FIRE strategy of basically stacking the S&P. Thus, comparing my original strategy, with the strategy I took after discovering Bitcoin. So, without Bitcoin, my savings stack would be the blue line here. As you can see, stacking Bitcoin is like finding the cheat code because I am currently 10x more profitable compared to the FIRE strategy. And in my humble opinion, it’s only going to get worse for the FIRE strategy going forward.

Conclusion

Following your DCA Bitcoin strategy will feel pointless and boring at times. All hodlers going through periods of pain, disappointment and feeling stupid. But, and that’s the important thing, after this pain, and when Bitcoin starts to catch on again (and it will), you always wish you had stacked more Bitcoin. With your DCA strategy, you are grateful that you've been doing this boring, useless thing for the last few years and are finally seeing progress. Bitcoin is always bitter-sweet. You feel down when the price goes down, but you also feel (kind of) down when the price goes up, because it's harder to get more Bitcoin (and you *never* have enough).

In my opinion, the "Bitcoin Retirement Plan" is really for everyone, regardless of how much you are able to stack. The truth is, your government retirement plan won’t provide financial freedom, so there is no way around to provide for yourself. So why not build a Bitcoin retirement pile on the side with everything you can. Fast-forward 10 years or more, and I bet your Bitcoin plan has a better chance of serving you well than the government Ponzi one.

And if you're reading this without owning any Bitcoin, I understand that you may feel it's too late. But here's the thing: Regardless of the entry date, everyone feels like they are late to Bitcoin. You can't change the past, but you can change your future. DCA Bitcoin, because it is shrimply the best.

The End

That's it for this episode. I hope you gathered some valuable knowledge from this one. My takeaway: Time in the market is better than timing the market. Many thanks to Mr. ERB who ran the numbers for us. Make sure to follow him, and keep up-to-date with the numbers:

Twitter: Bitcoin Retirement Plan

Blog: Stacking‘em Volume

Thanks for reading and see you hopefully in the next one. Until then, remember: Stacking Sats regularly matters. ₿ critical, ₿ informed, ₿ prepared. Yours,

Further reading

[VII] Bitcoin in Guatemala

[V] Storing and inheriting Bitcoin

Recommended Hardware - Wallet

F* Ledger! Read everything about Bitcoin Self-Custody in my episode ‘Take back control over your Bitcoin, now’ and get yourself a proper hardware wallet: Shiftcrypto’s The Bitbox Bitcoin only is my favorite. Swiss made | Great customer support | Worldwide shipment.

Books you can’t fuck with

[1] Carl Menger, Principles of Economics

[2] Brian Eha, How Money Got Free: Bitcoin and the Fight for the Future of Finance

[3] Nathaniel Popper, Digital Gold: The Untold Story of Bitcoin

[4] Jason P. Lowery, Softwar: A novel theory on power projection and the national strategic significance of Bitcoin

[5] Knut Svanholm, Everything divided by 21 million

[6] Ryan Holiday, Courage Is Calling: Fortune Favors the Brave

[7] Alex Gladstein, Hidden Repression: How the IMF and World Bank Sell Exploitation as Development

This is excellent. Thanks for sharing!

Nice post. A follow up post addressing how to determine the point of exit from corporate slavery based on BTC stack would be valuable. I understand that it will be different for everyone based on the annual expenditure needs of the individual and how long they need to plan to live in that mode (retired) - 20,30, 40, 50 years and so on. Also, how can one live a retired life on a BTC stack? Paying mortgage, utilities, etc in fiat or moving to a jurisdiction where payment can be made in Sats? If so, with fluctuating USD parity, how would one price the annual expenditure to live in retirement? 7-8% of BTC pot in USD or Sats? So many questions that are swirling in my head right now w.r.t how to practically retire on BTC. Would appreciate a post on these questions.