When Money Dies

Episode XVIII. Block height: 848600. The early signs of hyperinflation and the consequences for society. History does not repeat, but it often rhymes.

At first, the effects of inflation were subtle. Prices began to rise gradually, and the citizens adjusted their spending habits accordingly. But as the government continued to print money with abandon, inflation spiraled out of control. Prices doubled, then tripled, and before long, the fiat currency was worth less than the paper it was printed on. Panic set in. A dystopian cityscape is engulfed in chaos and despair as the once-thriving economy has collapsed under the weight of fiat hyperinflation. The bustling markets, once teeming with life, became battlegrounds. Merchants hiked prices multiple times a day, and shoppers rushed to buy goods before they became even more expensive. Basic necessities such as food, clothing, and medicine became luxuries. The sky is a fiery red, illuminating the smoldering rubble of abandoned buildings and crumbling infrastructure. The streets are littered with discarded currency notes, now worthless except as kindling for makeshift fires that provide warmth to the desperate survivors huddled in doorways and alleyways.

In the modern world, money serves as the lifeblood of economies, facilitating trade, investment, and daily transactions. It is the bedrock upon which the complex structures of contemporary financial systems are built. However, history has shown over and over again that fiat money will "die," always as a result of government mismanagement and money printing. The consequences of such a scenario are profound and far-reaching, affecting every facet of society. This episode explores the early signs of fiat money destruction, drawing on historical examples to elucidate the economic, social, and political ramifications of this catastrophic event.

Historical Examples

“Gradually, then suddenly” - This short phrase describes hyperinflation the best. There is a long time period where nothing happens, but once trust is lost, the currency is gone in an instant. The cases of Weimar Germany and Zimbabwe provide stark illustrations of what happens when money dies.

Weimar Germany

Post-World War I, the Weimar government faced immense economic strain due to the heavy reparations imposed by the Treaty of Versailles. To meet these demands and cover domestic expenses, the government began printing vast amounts of money, leading to hyperinflation. The value of the German mark plummeted, and prices soared to unimaginable heights, with the cost of basic goods doubling within days. All the German Mark that existed in the world in the summer of 1922 (190 billion) were not worth enough, by November 1923, to buy a single newspaper or a tram ticket. Workers were paid twice a day because their wages would be devalued by the afternoon. People’s savings were wiped out, and daily life became a struggle for survival as currency became worthless. But this was just the endgame, because 90% of the German Reichsmark value had already been lost before the middle of 1922, when most people still believed in the German currency.

This economic chaos eroded public trust in the government and created fertile ground for political extremism, contributing to the rise of Adolf Hitler and the Nazi Party. The Weimar Republic's experience underscores the devastating impact that unchecked money printing and poor fiscal management can have on a nation's stability and morals.

Zimbabwe

Zimbabwe’s experience in the early 21st century was similarly dire. Under the leadership of President Robert Mugabe, the government embarked on aggressive land reforms and reckless fiscal policies, including excessive money printing to fund public expenditures. The annual inflation rate is peaking at an astounding 89.7 sextillion percent. The Zimbabwean dollar became so worthless that it was abandoned in favor of foreign currencies. Citizens were forced to carry bags of banknotes for basic purchases, and the economy ground to a halt as businesses struggled to price goods and services in a hyperinflated market. Savings were obliterated, and bartering became commonplace as trust in the currency evaporated.

The hyperinflation crisis had profound social and economic consequences for Zimbabwe. Unemployment and poverty skyrocketed, leading to widespread food and fuel shortages. The public's trust in the government eroded as savings were wiped out, pensions became worthless, and essential services deteriorated. Many Zimbabweans turned to bartering and foreign currencies to conduct transactions. In 2009, the government finally abandoned the Zimbabwean dollar, officially adopting a multi-currency system to stabilize the economy. The hyperinflation period left deep scars on the society, highlighting the catastrophic effects of economic mismanagement and the urgent need for sound fiscal policies.

Early Signs

As the two examples of Zimbabwe and Weimar Germany clearly show, hyperinflation has terrible consequences for society. Therefore, it is even more important to spot early signs that often manifest subtly but escalate rapidly if unchecked.

Initially, there might be a noticeable increase in the prices of goods and services, outpacing normal inflation rates. Consumers and businesses begin to experience a loss of purchasing power, with money losing its value more quickly than usual. Savings start to diminish in real terms, leading to a decrease in the public's confidence in the currency. Interest rates may rise as lenders demand higher returns to offset the depreciating currency value. Additionally, the government might respond to budget deficits by printing more money, further exacerbating the inflationary cycle. The velocity of money circulation increases as people rush to spend their money before it loses even more value, setting the stage for runaway inflation. These early indicators, if not addressed through stringent fiscal and monetary policies, can spiral into full-blown hyperinflation, wreaking havoc on the economy. In concrete terms early warning signs in our current system are:

The Price of Gold: The price of gold has been suppressed in recent years, but analysts predict significant movement if it surpasses $2500 per ounce. This level is seen as a critical threshold where investor interest and market dynamics could lead to substantial price increases, reflecting heightened concerns about economic stability and inflationary pressures.

Gold Acquisition by Central Banks: Central banks around the world continue to increase their gold reserves, signaling a strategic diversification away from traditional currencies especially the US dollar. This ongoing trend underscores gold's role as a store of value, a hedge against currency depreciation and geopolitical uncertainties.

IMF Governance Reforms: Proposed reforms to the International Monetary Fund (IMF) include adjusting the Special Drawing Rights (SDR) composition, potentially reducing the reliance on the US dollar. But the move by Russia and China away from using the dollar and Saudi Arabia selling oil in other currencies are also strong signs of the end of our centralized dollar-based fiat system. Such changes could signal concerns over the dollar's status as the global reserve currency and may serve as a warning of potential inflationary pressures associated with a weaker dollar.

System Glitches and Crashes: The occurrence of flash crashes in equity markets and systemic glitches like the one we just witnessed, where Berkshire shares and others lost 99.9% of their value, highlights the fragility of modern financial systems. These events, characterized by sudden and severe market declines followed by rapid recoveries, underscore the fragility of financial markets.

A Chinese Collapse: China's economic challenges pose complex implications globally. Short-term deflationary pressures may arise from economic slowdowns and reduced demand, while long-term inflationary risks stem from stimulus measures and currency policies aimed at supporting growth. Managing these dynamics is critical for global economic stability and market confidence.

Why Fiat Money dies

Government Spending

One of the primary drivers of fiat money depreciation is excessive government spending coupled with persistent budget deficits. When governments consistently spend more than they collect in revenue, they often resort to borrowing or printing money to cover the shortfall. This expansion of the money supply without a corresponding increase in the production of goods and services leads to inflation. As more money chases the same amount of goods, prices rise, eroding the purchasing power of the currency. This phenomenon is particularly evident during periods of war, economic crises, or political instability when governments prioritize short-term spending over long-term fiscal sustainability. Imagine this: There are only seven years in which the U.S. government has run a budget surplus since 1950!

Central Bank Interventions

Central banks try to manage a country's monetary policy and influence economic stability. However, their actions always contribute to fiat money depreciation and create economic turmoil over the long run by trying to fix short-term problems. One such action is the implementation of expansionary monetary policies, such as quantitative easing (QE). QE involves the central bank purchasing government securities and other financial assets to inject liquidity into the economy and lower interest rates. While intended to stimulate economic growth and prevent deflation during downturns, QE often leads to inflationary pressures if not carefully managed. Excessive liquidity in the financial system can fuel asset bubbles and undermine confidence in the currency's long-term value.

Conversely, central banks may also pursue contractionary monetary policies, such as raising interest rates or reducing the money supply, to combat inflation. While effective in controlling price stability, these measures can constrain economic growth and consumer spending, impacting overall confidence in the economy and the currency, especially if the mountain of debt is significantly high because refinancing becomes exponentially expensive. The more debt, the more fragile the economy becomes, and the narrower the actions of central banks are to ‘fix’ it.

Currency Devaluation

Governments may intentionally devalue their fiat currency as a strategy to boost exports and stimulate economic growth. By making exports cheaper and imports more expensive, devaluation aims to improve a country's trade balance. However, prolonged or abrupt currency devaluation can erode investor confidence and lead to capital flight, where investors move their assets to more stable currencies or jurisdictions. This loss of confidence can trigger a cycle of depreciation, as expectations of further devaluation prompt individuals and businesses to convert their holdings into foreign currencies or tangible assets.

Moreover, fixed exchange rate regimes, where governments peg their currency to a stronger foreign currency or a basket of currencies, can also contribute to currency instability. Maintaining a fixed exchange rate requires significant foreign exchange reserves and strict adherence to monetary policies. Deviations from these policies or external economic shocks can strain reserves and force governments to abandon the peg, resulting in rapid currency depreciation.

Economic Mismanagement

Political instability, corruption, and ineffective economic policies can exacerbate fiat money depreciation. Uncertainty about government stability and policy continuity undermines investor confidence and hampers long-term economic planning. In extreme cases, political crises or social unrest may lead to capital flight and a loss of faith in the government's ability to manage the economy responsibly.

What are the Consequences

Economic

The most immediate and obvious consequence of money dying is economic turmoil. Hyperinflation, the primary driver of monetary collapse, erodes the value of currency at an exponential rate. Prices for goods and services skyrocket, often within hours or days, making it impossible for people to keep up with the cost of living. Saving fiat money becomes pointless, and wages lose their purchasing power almost as soon as they are earned. This leads to a collapse in consumer confidence and a sharp decline in economic activity.

Businesses struggle to operate in such an environment. The unpredictability of costs and prices makes planning nearly impossible, leading to supply chain disruptions, reduced production, and layoffs. Investment dries up as the financial system becomes increasingly unstable. In extreme cases, the currency becomes so devalued that people revert to bartering goods and services because money is no longer a viable medium of exchange.

Social

The death of money has profound social implications. As the economy collapses, unemployment rises, leading to widespread poverty and destitution. The middle class, which relies heavily on savings and stable income, is often the hardest hit. The gap between the wealthy, who can sometimes shield their assets from inflation through investments in foreign currencies or commodities, and the poor, who have no such means, widens dramatically. This exacerbates social inequality and breeds resentment.

The strain on daily life can be immense. Access to basic necessities like food, medicine, and shelter becomes increasingly difficult. Public services, funded by tax revenues that are now worthless, deteriorate. Crime rates often increase as people become desperate to survive, leading to a breakdown in law and order. The social fabric of communities frays as trust erodes and individuals focus on their immediate survival.

Political

The political landscape is also dramatically altered. Governments lose credibility as they are seen as responsible for the economic disaster. Public trust in institutions erodes, and political stability is undermined. In many cases, such crises lead to significant political upheaval. For example, the hyperinflation in Weimar Germany created fertile ground for extremist movements, contributing to the rise of Adolf Hitler and the Nazi Party.

The destruction of money always leads to more authoritarian government measures, such as imposing price controls, expropriations, censorship of freedom of expression, strict rules on carrying weapons, rationing, and printing even more money, which only exacerbates the problem. Alternatively, they may seek external assistance, ceding some degree of sovereignty to international bodies like the International Monetary Fund (IMF) in exchange for financial aid and economic restructuring programs. These interventions often come with stringent austerity measures, which can lead to public protests and further instability.

Conclusion

The death of money is a catastrophic event that triggers widespread economic, social, and political turmoil. Hyperinflation, the primary cause of such a collapse, erodes the value of currency to the point where it can no longer function as a medium of exchange, store of value, or unit of account. The depreciation of fiat money is often a consequence of government and central bank actions that undermine confidence in the currency's value and stability. Excessive government spending, expansionary monetary policies, currency devaluation strategies, and political instability all contribute to inflationary pressures and currency depreciation, which are leading inexorably to more authoritarian governments.

General speaking, the more materialistic a society, the more curdle it hurts. Undoubtably, though, inflation aggregates every evil, ruins every chance of national revival or industrial success, and eventually produces precisely the conditions in which extremists of the right and left rise. Because of its unfairly discriminatory nature, hyperinflation brings out the worst in everybody. It all seems like madness, and it corrupts people’s values. Therefore, it becomes all the more vital to brace ourselves for such a scenario, nurturing our minds to withstand the storm without letting go of hope. Amidst the chaos, let us find gratitude for the treasures we hold and the inherent goodness that still glimmers in the world. And of course, it is always a good option to be prepared for the worst and hope for the best.

The End

That's it for this episode. I hope you got some valuable information from this one. The next chapter will unfurl a tale of preparation and protection, a guide through the labyrinth of fiat devaluation. We will explore strategies to shield ourselves from the looming shadows, fortifying our spirits and resources against the tides of government mismanagement and central bank printing. Thanks for reading, and see you in the next one.

₿ critical, ₿ informed, ₿ prepared. Yours,

Education for everyone

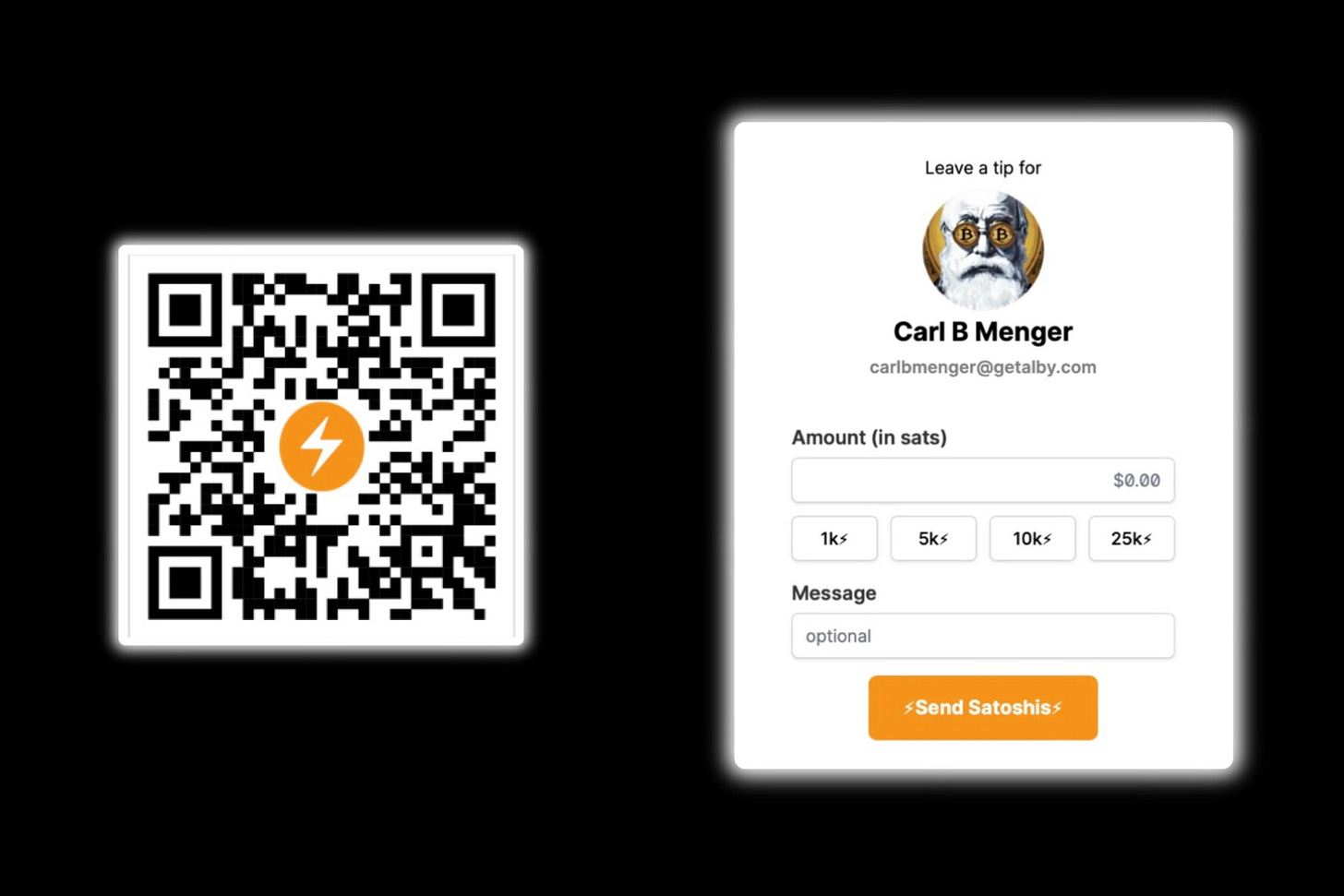

Pure, independent and free education. If you want to support my work, you can donate Sats via Lightning. I truly appreciate it!

Not your keys, not your coins

Get yourself a proper hardware wallet: The Bitbox Bitcoin-only! is my favourite. Swiss made, Great customer support and worldwide shipment.

Education is key

[1] Fernando F. Aguirre, Surviving Economic Collapse

[2] Philip Haslam, When Money Destroys Nations

[3] Jens O. Parsson, Dying of Money

[4] Rob Dix, The Price of Money

[5] Lyn Alden, Broken Money

[6] Ryan Holiday, Right Thing, Right Now

[7] Jörg Guido Hülsmann, The Ethics of Money Production

What a great piece. Slowly and then all at once, it's happened many times through history. There is a difference between the US and these other countries though. With dollars being the Global Reserve Currency it's unlikely we default like Zimbabwe with hyper inflation. The US has more of a "soft default" where we default through higher inflation forever. That currency debasement is exactly why we need to focus on trading our cash for assets over the long run to protect our purchasing power.