The Bitcoin Halving

Episode XIV. Block height: 837000. How the Bitcoin halving works and why it (still) matters.

To celebrate the upcoming fourth Bitcoin halving, which occurs in 3,000 blocks (Progress 98.5%) as of the time of this writing, I will cover the most important Bitcoin halving stats and facts. Of course, I get it, a lot of you folks already know that the Bitcoin halving is the event when the dollar value of Bitcoin gets halved, and this happens about every 4 years. So better sell your Bitcoin now, than being sorry later? Or is it more the other way around? Buy one tenth of a Bitcoin now and own a whole Bitcoin after the ‘having’?

After reading this and a lot of other misleading information about the Bitcoin halving, I had no choice but to write this article to clarify once and for all what the halving is and why it still matters. It is just remarkable how little people know about Bitcoin in general and the halving specifically. Even people who are successful in the financial sector make the strangest statements as you can see above. That simply understates how early we still are and is not a judgment but reality.

The Bitcoin Halving

As you may have guessed, Bitcoin halving does not mean that the price of Bitcoin halves or magically appear as more coins in your wallet. I mean, it is not some Shitcoin airdrop, right. Bitcoin halving is an event that reduces the SUPPLY! of newly produced bitcoin by half. To emphasize this once again, it is not the price in dollars that is halved, but the new quantity put into circulation. The new Bitcoin put into circulation is called mining reward, and it is very important for the security of the Bitcoin Network. To understand this better, let us quickly recap how miners are being rewarded for their energy expenditure and for validating transactions on the Bitcoin network.

Proof of Work

Transactions on the Bitcoin network are validated and confirmed by miners using a consensus mechanism called Proof of Work. In Proof of Work, miners are constantly validating transactions and grouping them into blocks. To prove that they did all the necessary work for the Proof of Work algorithm, they try to solve a mathematical problem. The first miner who finds the correct solution submits a newly created block to the network and is rewarded for their hard work with a mining reward. This reward is the main protagonist for the Bitcoin halving, because this is exactly the reward that gets cut in half when the Bitcoin halving occurs.

In January 2009, when the Bitcoin network was started, the first block, called the genesis block, was mined. According to the algorithm, the mining reward started at 50 Bitcoin. There have been three Bitcoin halvings so far (2012, 2016, 2020). This year, 2024, is the fourth Bitcoin halving, where the mining reward gets cut from 6.25 (900 daily) Bitcoin to 3.125 (450 daily). In general, Bitcoin halvings will occur roughly every 4 years until the year 2141, when the Bitcoin blockchain reaches the final number of 32 halvings and stops rewarding miners with block subsidies, so they will have to rely solely on transaction fees (more on this later).

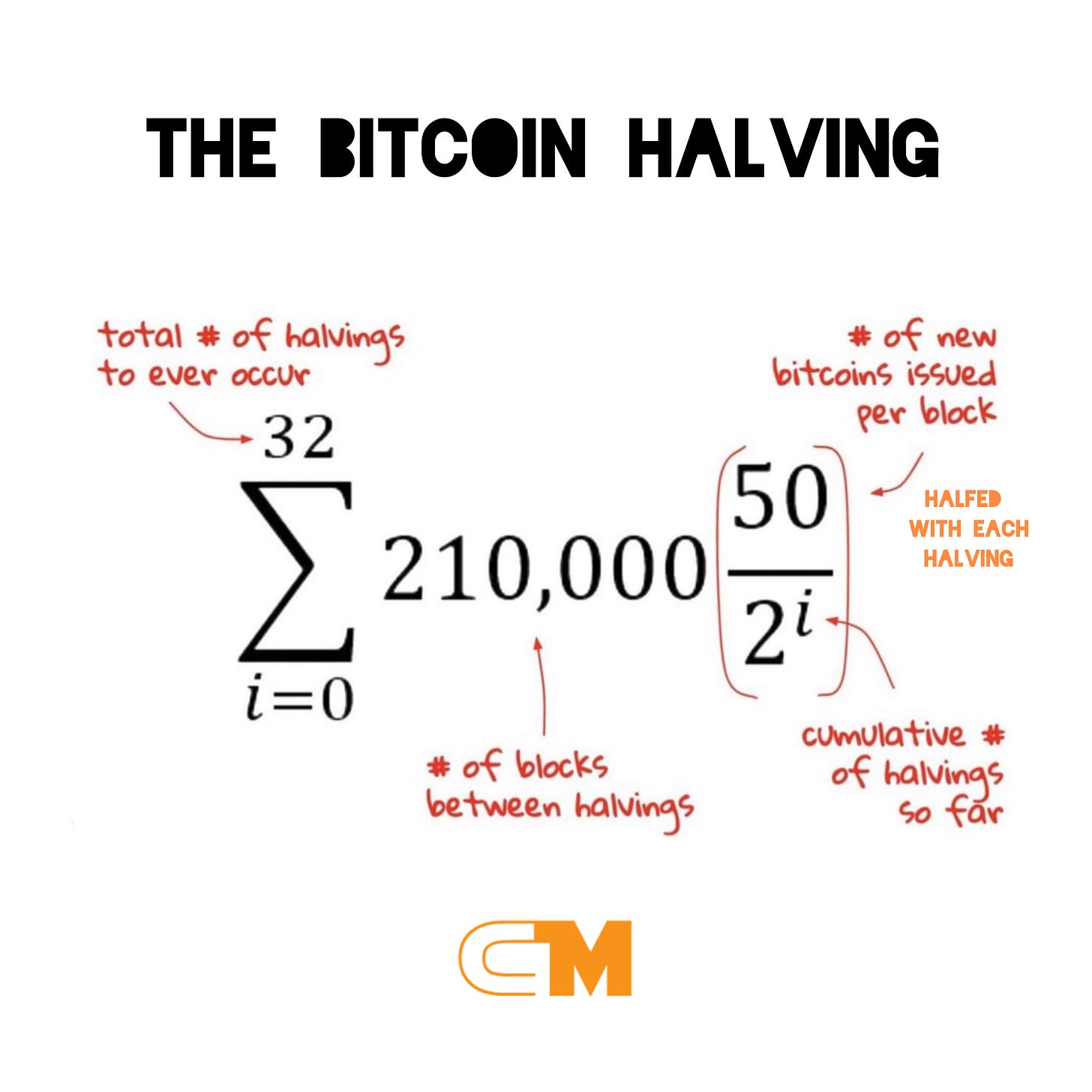

Let us quickly sum this: The incentive to mine Bitcoin and thus to provide computing power and energy to secure the network against attacks and validate Bitcoin transactions is that the miner receives Bitcoin in return, the so-called mining reward. This reward follows a fixed schedule, encoded in Bitcoin's DNA, and halves roughly every four years. This graph summarises the Bitcoin halving concept mathematically.

The Halving Code

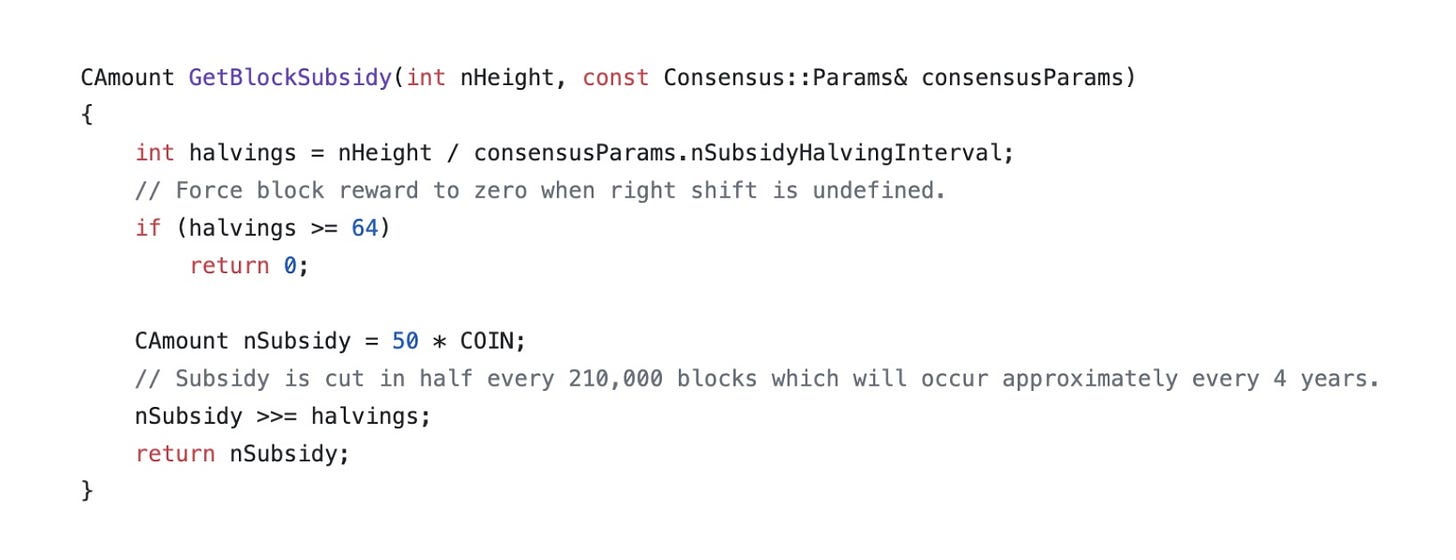

Let us go more in depth and start technical because, Code is law, not my words. The code snippet you see below is taken from the Bitcoin Core Github repository from the validation.cpp file, line of code 1750, that is responsible for validation the concept of the Bitcoin halving.

We weren't very precise at the beginning. As you can see when looking at the code, the time of the Bitcoin halvings is not measured in years but in blocks. The number of halvings is calculated using the current block height (nHeight) and subsidy halving interval (nSubsidyHalvingInterval) which is a constant equal to 210,000 that represents the number of blocks after which a halving occurs. Assuming that a block is mined on average every 10 minutes, we can quickly calculate that it should take roughly 4 years to mine 210,000 blocks.

The next two steps are also quite interesting. We have an ‘if’ check that returns 0 when halving is greater or equal to 64, which is mostly used to protect the right-shift operator that comes later. However, this doesn’t mean that there will be 64 halvings, because the actual subsidy will be 0 from the 33rd halving onwards. The next step is to just get the first block subsidy in Satoshis (The smallest unit of Bitcoin, like cents to Euro). COIN constant represents one Bitcoin in Satoshis (One Bitcoin = 100,000,000 Satoshis).

Now we’re getting to the actual calculation, which is performed by using the right-shift bit operation instead of division, for performance reasons. If we start with 5,000,000,000 (50 * 100,000,000) and begin right-shifting it, we can quickly see that the maximum number of times we can iterate is 32. At the 32nd attempt, our reward will be one Satoshi; if we shift one more time, it will give us 0 as a result. We can quickly calculate that if one halving occurs every 4 years on average, this means that the mining reward will stop around the year 2141.

Why does it matter?

There are a few main theories why the Bitcoin halving (still) matters or won‘t. Let us dive into some of them.

Sound Money Theory

The Bitcoin halvings create controlled issuance of Bitcoin with a perfectly predictable monetary policy. It is not true that Bitcoin has no inflation, yet. The current inflation rate is at around 1.8% and will decrease to around 0.8% after the fourth halving. The inflation rate will be decreasing to 0 over time. After that, Bitcoin becomes deflationary as some of the already existing Bitcoin will be lost.

A fixed schedule of issuance means, that there are no hidden expropriations. Even if Bitcoin is currently still inflationary, all participants know this by informing themselves about it. Bitcoin is open source and can be accessed around the globe. The fraudulent thing about the fiat system is precisely that nobody really knows how high the hidden expropriation through inflation is. Making things worse, that’s intended by governments to run huge deficits that needs to be inflated away over time.

Scarcity Theory

From a mere demand/supply perspective, the Bitcoin halving matters tremendously. In theory, Even if the demand for Bitcoin stays the same over time, if the new issuance gets cut in half, every 210,000 blocks, it should cause the price of Bitcoin to go up because the same demand meets less new supply. With the current supply, the market is able to absorb 900 new Bitcoin per day (considering that most miners sell their rewards instead of hoarding to cover expenses). After the halving, the amount of newly created Bitcoin will drop to 450 per day. If the demand stays the same, the price of each coin should increase. The Bitcoin market, of course, is not that easily predictable, and even though previous halvings had a positive impact on the price over time, there are no guarantees, with the exception of short term volatility.

No Impact Theory

More and more people (also in the Bitcoin Space) are of the opinion that the halving has little or no influence on the Bitcoin price, because the amount from 6.25 Bitcoin to 3.125 is no longer as significant as the reduction at the beginning from 50 Bitcoin to 25. However, I cannot relate. Of course, the quantity reduction is no longer as drastic, but the value per Bitcoin has increased significantly over time. At the first halving in 2012, a Bitcoin was worth around $12; now it is hovering around $70k. What does this mean?

After the first halving in 2012, the issuance of new Bitcoin was 3600 daily, multiplied by the price of $12, which equals $43.2k worth of Bitcoin daily, cut from $86.4K before the halving. At them moment (March 2024), Bitcoin’s worth of $63 million are issued daily ($70k * 900), which is reduced to $31.5 million ($70k * 450) after the 2024 halving. Seeing those numbers, it looks to me like the halving has more significance than ever, especially in light of the fact that institutional adoption (i.e. EFTs) has made it easier than ever for larger entities to stack Bitcoin, increasing the potential demand substantially.

Despite the fact that the quantity of Bitcoin is not reduced as drastically as it was at the beginning, the dollar value is. I therefore still assume that the halving will have a significant impact on the price over time. The efficient market theory, i.e., that we know in principle that the Bitcoin halving will occur and that it is therefore already priced in, is a fairy tale. As mentioned at the beginning, knowledge of Bitcoin is marginal, even among financial experts, not to speak of normies, so how can one then claim that all market participants are acting efficiently and rationally? Of course, there are no guarantees, and this is not financial advice! Do your own research, and don’t trust an old, grumpy guy that popped up in your mail account. Verify!

What happens after 2140

As we have already learned, the last Satoshi (the smallest unit of a Bitcoin) will be mined in 2140. Now, of course, the question rightly arises as to what will happen after that. One thing is for sure: Miners will no longer be incentivised to mine Bitcoin with new coins, but by collecting transaction fees solely. This also means that on-chain transactions will definitely become more expensive over time. Therefore, at some point, not everyone will be able to afford on-chain transactions, so they will only be used when truly necessary (Substantial amounts).

However, this will not make Bitcoin exclusively accessible to the elite, as work is already underway on so-called 2nd layer solutions. The best example in this context is the Bitcoin Lightning Network for small to medium amounts that can be carried out instantly, to buy your cup of freshly ground coffee, for example. But this is another topic, and if you want to dig deeper into the Bitcoin Lightning Network, here is my Lightning Article.

The End

That's it for this episode. I hope you gathered some valuable knowledge from this one. Keep STACKing and HODLing for the long run. Thanks for reading, and I hope to see you in the next one. Until then, remember: Not the price gets halved during the Bitcoin halving but the quantity of new issued Bitcoin.

₿ critical, ₿ informed, ₿ prepared. Yours,

Not your keys, not your coins

Read everything about Bitcoin Self-Custody in my episode ‘Take back control over your Bitcoin, now’ and get yourself a proper hardware wallet: Shiftcrypto’s The Bitbox Bitcoin only is my favorite. Swiss made, Great customer support and worldwide shipment.

Education for everyone

Pure, independent and free education. If you truly want to support my work, you can donate Sats via Lightning. I truly appreciate it!

Be informed

[XIII] The Lightning Network

[XII] CBDC‘s: A brave new world

[XI] Valuing Bitcoin

Education is key

[1] Andreas Antonopoulos, Mastering Bitcoin

[2] Lyn Alden, Broken Money

[3] Philip Haslam, When Money Destroys Nations

[4] Ammous Saifedean, The Bitcoin Standard

[5] Ayn Rand, Atlas Shrugged

[6] Donald Robertson, How to think like a Roman Emperor

[7] Robin Sharma, The Monk who sold his Ferrari